Massachusetts Paid Family and Medical Leave Tax

This article includes an overview of how to set up the Massachusetts Paid Family Leave and Medical Leave Tax in Namely Payroll.

Process

BACKGROUND

On October 1, 2019, Massachusetts added a Paid Family Leave Tax for employees and a Paid Medical Leave Tax for employees and employers. For information on current rates and wages, please refer to2022-2023 Federal and State: Payroll and Tax Fact Sheet.

Things to consider:

-

If an employer elects to pay 100% of the Medical and Family Leave taxes for the benefit of their employees, the employee portion of the taxes must be excluded by Namely. The employee contribution will be automatically added to the calculation of the employer portion of this tax.

-

Employers with less than an average of twenty-five employees in the lookback period of the prior calendar year are not required to pay the employer portion of the medical leave tax. Companies with employees in Massachusetts who do have enough employees to qualify for the employer medical leave tax must have to have the tax excluded by Namely.

-

Companies can apply for an annual exemption from this tax if they have a private plan making them fully exempt. You can request this exemption from Namely by submitting a case Help Community.

NEXT STEPS

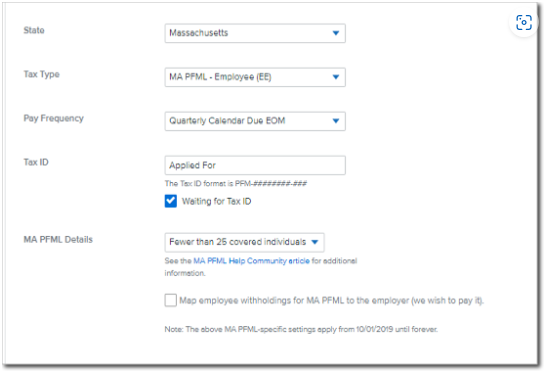

You can add the appropriate taxes to your company tax setup in Namely Payroll by clicking Company > Tax. Two different types of taxes can be added:

-

MA PFML - Employee

-

MA PFML - Employer

Namely will automatically include the Employer and Employee Medical Leave taxes and the Employee Family Leave tax for companies that have at least one employee in Massachusetts. After this tax has been implemented, a prompt will appear between Steps 1 and 2 of Payroll Processing to enter the Tax ID and Pay Frequency.

TIP:

Pay Frequencies for these taxes are quarterly. Once you have received your Massachusetts PFML ID Number, enter it in the Tax section in order for Namely to remit the payments on your behalf.

Further Configuration

You also have the opportunity to select the size of your company right on the page. In the MA PFML Details dropdown, you can select either

-

Fewer than 25 covered individuals

-

25 or more covered individuals

Be sure to choose the selection that reflects you and your company.

We've also made it easier to tell us whether you as a company, want to pay the employee portion of the tax. Simply click the checkbox next to Map employee withholdings for MA PFML to the employer (we wish to pay it) and it will automatically map your employee withholdings to your company's.

Tip:

This feature is unavailable for the MA PFML Employer as it will automatically select and map over the information from the MA PFML Employee configuration.

Private Plans

If you have a MA PFML Private Plan and want to deduct the allowable employee contributions, you will need to follow the steps below. Since contributions are a percentage of an employee’s taxable wages and Namely Payroll’s deduction setup can only accommodate a percentage of the employee’s gross or net pay, not taxable wages.

Set Up as Tax

You should use this setup if you plan on deducting the full amount allowable (this amount will change each year based on the rates set by the state).

MA PFML employee contributions are allowed for a private plan but must not cost your workers more than they would be required to contribute to the state plan under the paid leave law. The allowable rates and wage base will change each year. Since this is set up as a Company Tax, the system will automatically be updated each year to reflect the proper rates and wage base.

With this setup, the employee portion of the taxes will be withheld based on a percent of the taxable wages up to the wage base. The amounts collected from employees will not be collected from you. You should use the collected tax amounts from the employees to offset your MA PFML private plan premiums. Tax returns will not be filed as long as you have the Applied For status as the Tax ID.

TIP:

You may receive automated messages advising them they have a missing tax ID for MA PFML; those should be disregarded.

Set up as a Deduction

You should use this setup if you plan on deducting less than the full allowable amount (this amount will change each year based on the rates set by the state).

TIP:

Correct setup is essential for the tax to be withdrawn as expected.

Prerequisites

You must have a MA PFML private plan approved by the agency.

Procedure for Tax Setup

-

Set up your MA PFML in Namely Payroll for the employee portion of the tax only.

-

This can be done by selecting Fewer than 25 employees.

-

-

Enter the Tax ID as Applied for by choosing the Waiting for tax ID checkbox.

-

You are responsible for leaving the Tax ID in the Applied for status. The Applied for status will ensure that the employee deductions are not collected by Namely and the tax filings are not filed.

-

-

Log a case in the Help Community under Payroll > Tax Services > Tax Profile Audit stating that you have a private MA PFML plan and want to collect the employee portion of the taxes (premiums).

Procedure for Deduction Code Setup

To ensure correct taxation, the deduction code for MA PFML Private plan must be used, and the deduction code must be mapped to box 14 on the W2. Follow the steps below to complete this.

-

In Namely Payroll go to Company > Deduction > Add Deduction.

-

Once the deduction is added on the company level, you will need to add the deduction to all applicable employees.

Tip:

You should calculate the percentage and set a maximum per year based on the current years wage base for MA PFML.

-

Log a case in the Help Community under Payroll > Tax Services > Tax Profile Audit stating that you have a private MA PFML plan. Be sure to note that a deduction should be set up to collect from the employees.

FREQUENTLY ASKED QUESTIONS

Do I have to add the rates of these taxes to Namely?

No, these rates are hard coded in Namely. Front-end adjustments will not be necessary.

I’m still applying for a SUI ID number. Will Namely collect for this tax each pay period, and remit payments at the end of the quarter?

No - similar to SUI taxes, Namely will be unable to collect or remit taxes on your behalf until an ID number has been provided.